Oreteki Game Breaking News: JIN, misunderstood advice from respected Emin and suffered a huge loss?

Emin Yurumazu mentions Shooting Star

JIN's YouTube live broadcast of my game news was broadcast late at night from August 16th to 17th, 2023.

【FX生配信】破産しそう https://t.co/vtZUqFaUSk @YouTubeより

— オレ的ゲーム速報JIN@FX・株投資部 (@oreteki_douga) August 16, 2023

It continued to trade from around 130 yen to the dollar, and finally the unrealized loss was 90 million yen.

17th Aug, when the dollar yen exceeded 145 yen, it became even more popular.

Emin Yurumazu's post seems to be one of the factors supporting his hope that the dollar/yen will fall.

ドル円はここ2-3日ローソク足でシューティングスター(流れ星)が出るのかなと思って見ていますが、毎回伸びて綺麗な陽線で終わっています。今日こそ出るかもしれません。出たらトレンド転換のサイン。 pic.twitter.com/bKyn7iAkDm

— Emin Yurumazu (エミンユルマズ) (@yurumazu) August 15, 2023

[Translation]

I've been watching the dollar/yen candlesticks for the past 2-3 days, wondering if a shooting star will appear, but each time they grow and end with a beautiful positive line. It might come out today. If it appears, it is a sign of a trend change.

If the candlestick on the dollar yen chart is a shooting star, the trend has changed.

Did JIN misunderstand the meaning of Shooting Star?

However, from what I heard from JIN, there is a section where he seems to think of Shooting Star as positive lines for 7 days.

There are so many positive lines (a shooting star has appeared).

That's why the trend will change, he says.

Looking back at his words and actions so far, he has been keeping in mind the probability of positive and negative lines, and from a technical rather than fundamental perspective, there is no way that the positive line will always be positive, but the positive line has continued for many days, and today is the day.

Even if you thought that it would be a negative line, that is, it would go down, it would make sense.

Meaning of shooting star in the market

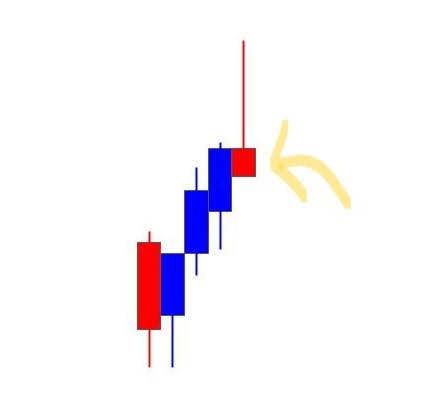

However, the shooting star in the market refers to the formation of candlesticks with long upper shadows and almost no lower shadow in an uptrend, rather than the arrangement of candlesticks on the chart.

I created a simple image.

It is thought that it is so called because its long upper shadows and almost no candle parts give it the appearance of a shooting star.

Emin then said that if this candlestick appears, the uptrend will turn into a downtrend, so pay attention.

Is it a bad advisor or a bad listener?

However, based on Emin's use of the term "trend reversal" and his own empirical theory that the positive trend cannot continue, JIN sold more, thinking that the dollar/yen would fall.

After that, contrary to JIN's expectations, the dollar and yen rose further.

He was horrified by the momentum and ended up cutting off the additional sales.

He followed the advice of Emin, whom he had said he had a lot of respect for and believed in, but he misinterpreted it.

We may be doing this quite a lot without even realizing it.

This means that our own strong desires are a contributing factor to destroying our cognitive biases.

JIN did not say that Emin's prediction was wrong, but there may be some people who think that the experts' statements cannot be trusted due to their own misunderstandings.

That kind of thing is not good for either party.

Does this mean that sometimes it is necessary to reevaluate whether the person giving the advice is wrong, or whether our own interpretation is wrong?

Can he recover on his own without advice?

However, it is true that JIN cut its losses this time but calling it a "huge loss" may be an exaggeration.

Compared to his unrealized loss of 90 million, the amount he lost was only about 1/100th of that amount, and although he mistakenly predicted a trend reversal, the dollar-yen pair has actually maintained its upward momentum since then.

Maybe JIN's position can be saved.

In stocks, there are hundreds of millions of traders in both name and reality, and in FX, there is a possibility that it will end in positive territory.

Although JIN was not able to make effective use of Emin's advice, he has experience.

JIN's trade may seem like he is taking a position based on a sense of affordability, but this sense of affordability is essentially a type of technical technique.

The signal indicator that represents Bollinger Bands is a visual and mechanical representation of the experience value, and although it is not easy to explain the reasonable price, it may actually have the same function as the indicator.

Therefore, it cannot be said that the sense of the prices is not reasonable.

Also, there is no doubt that JIN, who has survived even the roughest market conditions and left profits, is a fund management professional.

- Don't use too much leverage.

- Always be aware of margin maintenance rate.

- Having a source of income other than investment.

I think there is a lot that investors can learn from this.

Please pay attention to JIN's real trading, which is being broadcast live.

Oreteki Game Breaking News JIN FX/Stock Investment Department - YouTube

0 件のコメント:

コメントを投稿